Pushback: Wall Street landlords are coming to our zip code

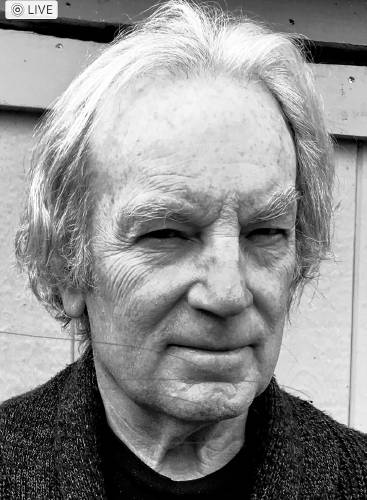

Al Norman

|

Published: 11-19-2024 3:26 PM

Modified: 11-20-2024 8:41 AM |

On Oct. 29 I was mailed a check for $320,310 from Ocean City Development, LLC, of Wakefield, offering to buy my Greenfield home “as is.”

The next day the Wall Street Journal ran a five-column story with the subheadline: “ZIP codes where investors own a bigger share of houses see higher-than-average increases in home prices and rents.” According to the WSJ: “More than a decade ago, private equity giant Blackstone began spending hundreds of millions of dollars on family homes that went into foreclosure … creating a new asset class for institutional investors. Since then corporate landlords bought more than 600,000 houses in the U.S.” These landlords are sharing tools provided by private equity firms to collude to keep rents high.

On Oct. 16, three state lawmakers came to the Greenfield City Council to answer questions from city councilors. One councilor asked, facetiously: “Are [Accessory Dwelling Units] going to all be bought up by the BlackRock capitalists of the world, so we shouldn’t build them at all?”

But Congress is taking these Wall St. landlords more seriously. Senator Elizabeth Warren is a sponsor of the Stop Predatory Investing Act (SPIA), filed in response to private equity firms, Real Estate Investment Trusts, and other large investors buying up a growing number of single-family homes. In 2021, institutional buyers bought over 28% of the homes sold in Texas, and over 50% of the homes in certain Atlanta zip codes. “These corporate investors focus on smaller, more affordable homes — taking critical starter homes that could otherwise go to first-time homebuyers,” the Senate Banking Committee said. SPIA would prohibit an investor who acquires 50 or more new single-family rental homes from deducting interest or depreciation on those properties. The legislation incentivizes investors to sell these properties to homebuyers or non-profits, in order to deduct interest and depreciation from their taxes.

The WSJ article notes that investor landlords “are able to charge tenants high rents relative to what they have paid for the property.” Regular home-buyers will find it tough to compete for homes, when corporate landlords are offering full cash. “First-time buyers don’t like to compete with Wall St. investors when they try to get on the property ladder. Existing owners might not like the volatility corporate owners bring to home prices either.”

Gov. Maura Healey made home ownership a key component of her Affordable Homes Act. “Homeownership is one of the primary paths to building intergenerational wealth and remains an important part of the American dream here in Massachusetts,” the governor said. “Increasing access to these important homebuyer programs is crucial to helping families put down roots and strengthen communities.”

The governor’s law authorizes $50 million for MassDreams to create first-time homebuyer opportunities. It authorizes $100 million for the Commonwealth Builder Program to spur the construction of affordable single-family homes in many municipalities. The bill creates a Homeownership Tax Credit for first-time homebuyers.

The Massachusetts Housing Partnership offers the ONE Mortgage program which has helped 22,000 low and moderate income households buy a home, with a 30-year fixed rate, a 3% downpayment, and no private mortgage insurance. In September, Boston Mayor Michelle Wu announced a $10 million commitment of mostly federal ARPA funds to provide up to a $75,000 down payment assistance, to have the city buy market-rate housing to sell to homebuyers, and to provide funding to developers to acquire rental properties at below market rates. In Connecticut, the State Bond Commission has authorized $40 million for the “Time to Own” program for down payment loans and closing costs for first-time homebuyers, with 0% interest loans up to $50,000, fully forgiven, within 10 years.

Article continues after...

Yesterday's Most Read Articles

Greenfield should mix public and private funding sources to rehab “distressed” homes, or buy them, and put them back on the market for first-time buyers. Existing homes being foreclosed for back taxes or bank mortgage defaults, could be purchased by the city with bank, credit union, and Community Development Corporation assistance, and sold to first-time buyers. On Thursday night, Greenfield officials will review its plan for Community Development Block Grant Funds, including repairing dilapidated houses for resale to first-time homebuyers.

A mayor’s public/private Housing and Jobs Task Force should widen the pathway to home ownership, with financial incentives for first-time homebuyers, and a job strategy for living wage jobs to help pay off a mortgage. We should also stop pushing elders to move into smaller homes. That is not “aging in place.”

Readers should email: citycouncil@greenfield-ma.gov, urging all Accessory Dwelling Unit zoning amendments be continued until the state promulgates “reasonable regulations.”

Al Norman’s PUSHBACK column is published in The Recorder the first and third Wednesday of each month.

Connecting the Dots: It comes to us all

Connecting the Dots: It comes to us all Ira Helfand: A bomb survivors warn of nuclear danger

Ira Helfand: A bomb survivors warn of nuclear danger Michelle Spaziani: High municipal employee turnover merits immediate review

Michelle Spaziani: High municipal employee turnover merits immediate review My Turn: Massachusetts’ health system is failing

My Turn: Massachusetts’ health system is failing