Al Norman: Home equity theft is finally over

| Published: 08-07-2024 12:04 AM |

On Dec. 29, 2021, Mitch Speight and Joan Marie Jackson had a letter dropped on their front porch in Greenfield by the county sheriff’s office. It was a “Notice to Quit” from a local law firm. “You are hereby notified and requested to vacate the premises which you now rent. You will have until February 1, 2022 to vacate … or I will go to the Greenfield Housing Court and seek permission to evict you.”

In a column Mitch and Joan wrote in the Recorder in May 2022, they said: “This notice changed us from being homeowners one day, to squatters facing eviction the next. We had no idea that being delinquent in our property taxes could mean losing all our home equity. It wasn’t until we hired our own lawyer that we learned how Chapter 60 of the Massachusetts General Laws permits a municipality to ‘take’ our home title, and with it, all the equity built up in our home — which we owned free and clear.”

“We managed to avoid going over the home equity cliff,” Mitch and Joan explained, “by paying every tax owed, plus collection costs and interest. But the law that put us at the brink of eviction is unconstitutional. We don’t want to see any other homeowners ever have to go through what we went through.”

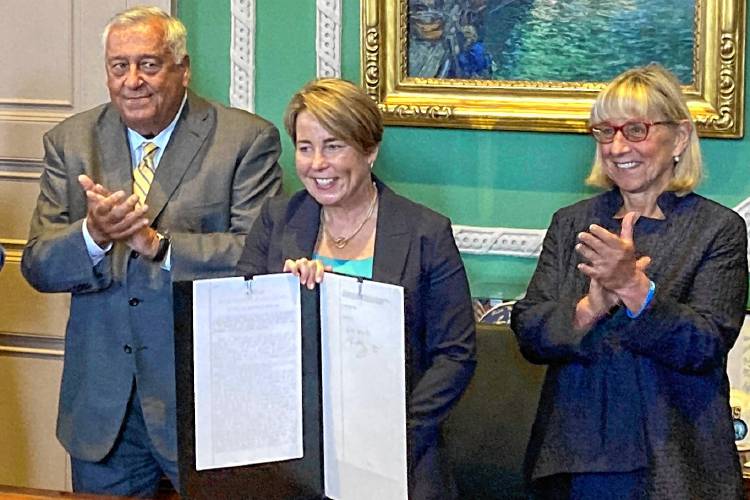

More than two years later, Mitch and Joan finally got their wish. Gov. Maura Healey signed into law the fiscal year 2025 budget bill on July 29, which included a section making the process of “home equity theft” illegal. Chapter 60, section 2C now says: “Following a foreclosure of the property, the former owner shall be entitled to any excess equity in the property, upon written request to the municipality.” No one will face this legal thievery again.

It was an enormous boost when the U.S. Supreme Court, on May 25, 2023, ruled that the practice of governments taking more than they are owed when collecting delinquent taxes violates the U.S. Constitution. The court unanimously said that a municipality “could not use the toehold of the tax debt to confiscate more property than it was due.”

The Takings Clause of the U.S. Constitution provides that “private property shall not be taken for public use, without just compensation.” The court concluded: “The taxpayer must render unto Caesar what is Caesar’s, but no more.”

In September 2023, attorneys Tom Lesser and Michael Aleo of Northampton filed charges in Federal District Court that Greenfield had violated the rights of Stephen Woodbridge under the Takings Clause of the Fifth Amendment and the Excessive Fines Clause of the Eighth Amendment “by seizing his home to recover the monies he owed to the Town of Greenfield, but refusing to pay him the balance between that amount and the value of the property seized.”

A second plaintiff, Roberta Browning, was added to the case shortly afterward. The lawsuit said Woodbridge owed a total of $5,762 in taxes on two parcels of land and a house. On Oct. 20, 2021, Greenfield sold Woodbridge’s home and 6.4 acres of land for $270,000. The city kept the other 13-acre parcel, worth at least $49,000, for nature trails.

Article continues after...

Yesterday's Most Read Articles

In October 2023, the city filed a motion to dismiss the case. Eight months later, federal Judge Timothy Hillman denied Greenfield’s motion to dismiss, noting that the city’s choice to take both of Woodbridge’s parcels “to line its coffers to this extent serves as a stark example why this statutory scheme is subject to constitutional challenge in multiple cases throughout the Commonwealth.” The Woodbridge/Browning case has still not been settled.

The law signed by Healey, based on legislation drafted by Sen. Mark Montigny of Bristol/Plymouth, with remarkable steadfast commitment and support from Sen. Jo Comerford, cuts the interest rate on delinquent taxes from 16% to 8%; lowers the minimum for a repayment agreement from 25% to 10%; allows a municipality to waive all the accrued interest; extends repayment plans from five years to 10 years; and requires auction bids to be at least two-thirds of the property’s appraised value.

Because foreclosures will continue, I urge all municipalities to establish “zero foreclosure” work groups to keep tabs on how many homeowners are at risk of foreclosure, and how we can reduce the number of foreclosures as close to zero as possible, using exemptions, abatements, tax deferrals, hardship exemptions and elder/disabled tax funds.

We will celebrate this victory now — but set a new goal of reaching zero foreclosures.

Al Norman’s Pushback column appears twice monthly on Wednesdays in the Recorder.

Al Norman’s PUSHBACK column appears the first and third Wednesday of each month in The Recorder.

Connecting the Dots: It comes to us all

Connecting the Dots: It comes to us all Ira Helfand: A bomb survivors warn of nuclear danger

Ira Helfand: A bomb survivors warn of nuclear danger Michelle Spaziani: High municipal employee turnover merits immediate review

Michelle Spaziani: High municipal employee turnover merits immediate review My Turn: Massachusetts’ health system is failing

My Turn: Massachusetts’ health system is failing